When we talk about the biotech industry today, the boundaries are not always very clear. There are certain interconnections with the fields of pharmaceuticals, medtech, life sciences and bioeconomy. Unfortunately, there are hardly any statistics on the real core of the industry; in most cases, all sorts of things are involved and dilute a clear view of the pioneering, innovative branch. Often, the goal is to count as many companies as possible on the basis of a broad definition in order to take an "advantageous" position, for example per country.

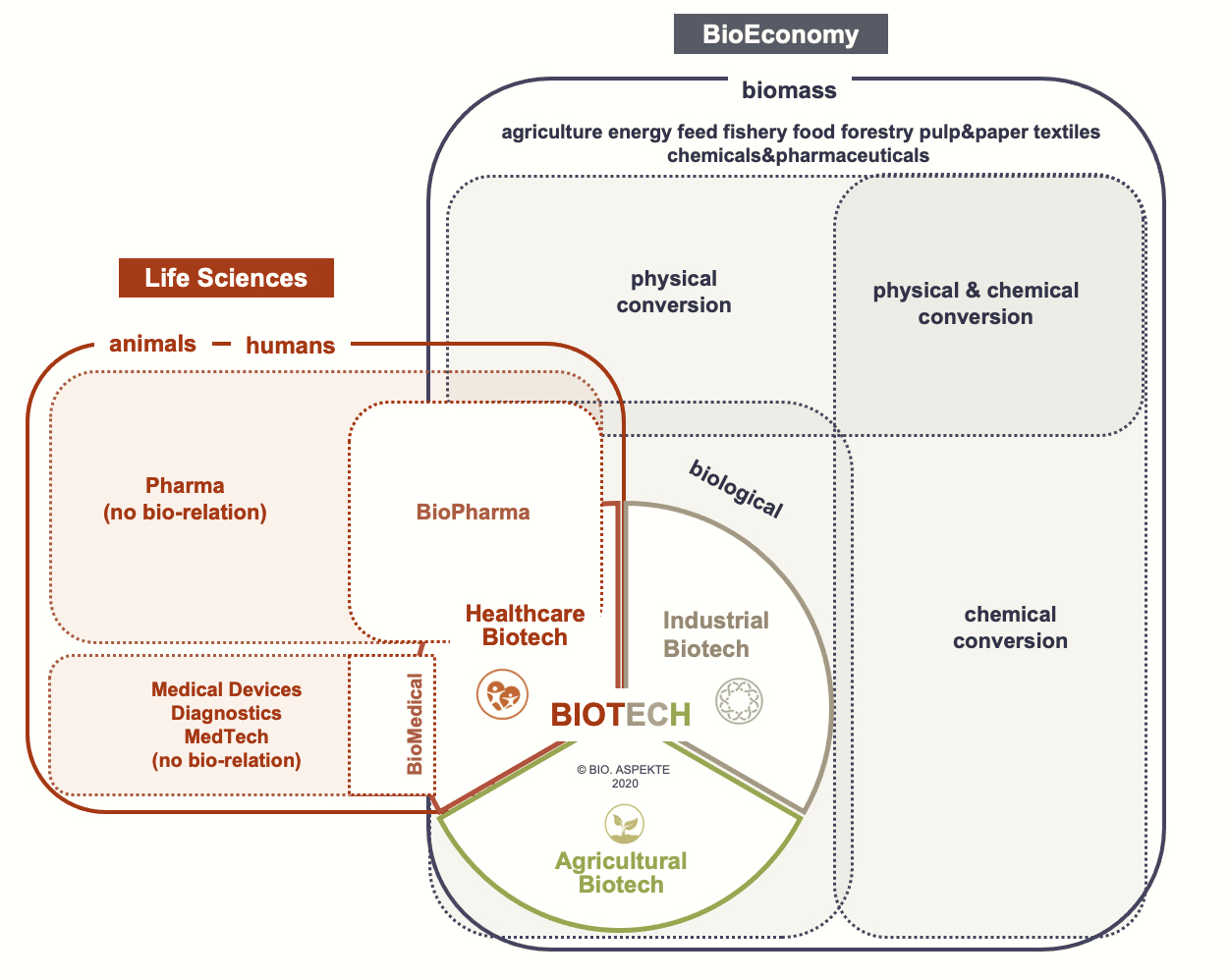

Biotech overlaps with the fields of life sciences and bioeconomy. The life sciences sector includes all companies whose products and services serve to maintain the health of humans and animals.

In addition to pharmaceuticals and medtech (also includes diagnostics), this can include companies involved in cosmeceuticals, nutraceuticals or other novel production methods for food. Furthermore, basic tools or also digitization approaches can be assigned to this area. Biotech itself overlaps here with pharma and medtech as BioPharma and BioMedical (e.g. tissue engineering) and with IT applications as bioinformatics. The latter is of course also available in other biotech sectors, e.g. in the plant sector.

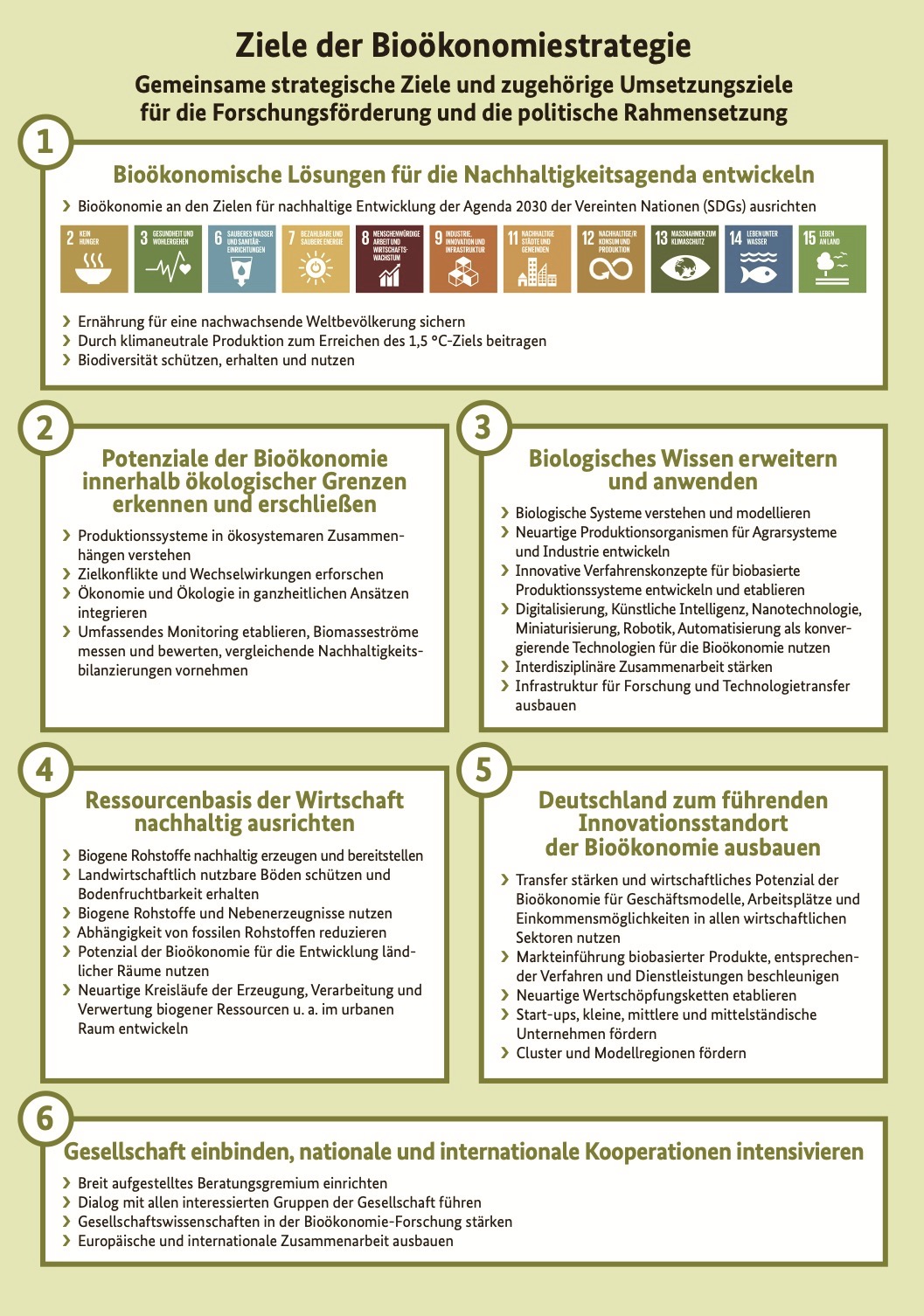

The term bioeconomy has been increasingly used in Germany for a good decade, also at the state level. In 2009, the German government established a Bioeconomy Council to advise it on the implementation of the "National Bioeconomy Strategy" adopted in 2020. According to the federal government, the bioeconomy is about the "production, development and use of biological resources (including knowledge), processes and systems to provide products, processes and services in all economic sectors as part of a sustainable economic system." The German Federal Ministry of Education and Research (BMBF) operates an information website on the topic. And, bioeconomy is the current topic of the Science Year 2020|21, also an initiative of the BMBF.

The rather not precise definition can be summed up more succinctly as follows: at the heart of the bioeconomy is a modern and sustainable form of economic activity, a bio-based economy. Instead of fossil raw materials, it uses renewable resources and also relies on a circular economy. The bio-based economy includes all industrial and economic sectors that produce, process or use biological resources in any form. These include, for example, agriculture and forestry, the energy industry, fisheries and aquaculture, chemicals and pharmaceuticals, the food industry, industrial biotechnology, the cosmetics, paper and textile industries, and environmental protection.

The biotech industry is therefore part of the bioeconomy. It is characterized by processing or using biological raw materials in "bio(techno)logical ways". Microorganisms, cells or components thereof are used throughout. To produce bioethanol by fermentation from renewable raw materials, these are for example saccharification enzymes and yeast.

Other options for processing biological resources use physical (e.g., pressure, heat) or chemical (e.g., acid, alcohol, chemical catalysts) technologies, which is then not biotech. Biodiesel, for example, is produced from canola plants through physical and chemical action. There is no fermentation step involved and therefore such producers do not count as biotech industry.

The bioeconomy is also on the agenda at the European level. The first EU concepts for the bioeconomy or bio-based economy emerged in 2005. This was followed in 2010 by the report "The Knowledge Based Bio-Economy (KBBE) in Europe: Achievements and Challenges" and in 2012 the European Commission published the strategy "Innovating for Sustainable Growth: A Bioeconomy for Europe". In the meantime, the integration of cycles (circular economy) also plays a major role here.

In the U.S., also in 2012, the U.S. government under Obama published its "National Bioeconomy Blueprint" strategy.

The "actual" biotech industry comprises companies whose main business purpose is based on the use of modern biotechnology (molecular biology & genetic engineering) and life sciences. In addition, there are companies that offer products and processes that are not "biotechnological" in the narrower sense, but which constitute important building blocks in the value chain of the biotech industry (e.g. bioinformatics, technologies and services in the field of drug development). Most of them are smaller companies respectively startups, but nowadays there are also some larger companies for which biotech has not become the sole but a very important pillar. Firms that use classic biotechnology for food or beverage production, such as bakeries or beer brewers and vintners, are not included in the modern biotech sector.

In "Understanding Biotech", the brief overview of biotech history shows that the fermentation industry is already older than 100 years. It began with the microbial production of (fine) chemicals, which in industry jargon is assigned to the application area of white biotech.

German companies were among the pioneers in this field worldwide. In 1895, for example, ten years after its founding, Boehringer Ingelheim started industrial fermentation of lactic acid as an additive for food. At times, this was the main source of sales. Other German lactic acid producers were Byk-Gulden from Konstanz (today Takeda), Schering from Berlin (today Bayer) and Merck from Darmstadt.

The industrial microbial extraction of citric acid was developed from 1923 by the US company Charles Pfizer & Company, founded in New York in 1849 by the two German immigrants Karl Pfizer and Charles Erhart. Prior to this, the substance was still isolated exclusively from citrus fruits.

In 1938, Boehringer Ingelheim also entered the field of citric acid production using a fermentation process. Today, the German pharmaceutical company no longer produces these fine chemicals. However, the fermentation know-how has remained and is applied to offer contract manufacturing for biopharmaceuticals.

Based on advances in molecular biology, today's biotech industry emerged in the U.S. starting in the mid-1970s, consisting mostly of smaller startups. Some of the U.S. pioneers founded in the 1980s (Amgen, Biogen, Gilead Sciences, Regeneron & Vertex Pharmaceuticals) are now large firms.

The top ten or so firms typically account for three-quarters of the revenue and market value of the publicly traded U.S. biotech industry. In turn, this accounts for about 90 percent of the overall U.S. industry in terms of sales.

Reaching the threshold of one billion U.S. dollars in sales catapults a biotech company into this class of "commercial leaders". In Germany, only Qiagen, which was founded very early on in 1984 and has since grown into a major molecular diagnostics specialist as well as offering products for sample preparation, has made it into this league so far.

Due to the Corona pandemic, the mRNA player BioNTech from Mainz followed second this year. Without this exceptional situation, their journey would probably have been a longer one as innovative mRNA-based approaches in cancer immunotherapy still have to show their full potential, eg in Phase III studies.

Along the path of growth, other early U.S. biotech startups were acquired by pharmaceutical companies, such as: Celgene by Bristol Myers Squibb, Cephalon by Teva , Chiron by Novartis, Genentech by Roche, Genzyme by Sanofi and MedImmune by AstraZeneca. The large, still independent biotechs can now rival the established pharmas, i.e. in terms of market value.

Market value is a good keyword to show the importance the biotech industry plays today: in addition to developing life-extending therapies, it also contributes to increasing value for investors. An investment more than 20 years ago (before the stock market hype in 2000) in the leading listed U.S. biotech companies would have increase the stakes more than thirtyfold: This is how the BTK stock market index, which comprises the top 30 biotech firms by share price on the New York Stock Exchange (NYSE), performed.

The value of the companies listed in the NBI, the biotech index of the U.S. tech exchange NASDAQ (National Association of Securities Dealers Automated Quotation System) also achieved growth of around fifteen times during this period. The NBI brings together biotech companies with a market value of at least US$200 million, currently more than 250 companies.

Compared with the growth of the biotech indices, the corresponding indicator for pharmaceutical companies listed AT NYSE (DRG) has only shown an increase of slightly more than double in the last 20 years. Even the U.S. Dow Jones Industrial (DJI) index, which is comparable to the German DAX, was higher, with an almost fourfold increase. As was the DAX itself, with a tripling of its value. The pharmaceutical industry has been struggling for some time with a decline in the efficiency of its research and development (R&D): investments are producing less and less output in terms of newly approved drugs. However, among the market approvals that have taken place, innovative drugs are often based on the know-how of acquired biotech companies!

Biotech has thus become the innovation engine for pharma. In order to underline this, some pharmaceutical groups now also refer to themselves as "biopharma firms".

Since 1982, when recombinant human insulin was the first biotech drug to be launched on the market in the U.S., many others have followed in this new class of drugs. Also known as biologics, they are characterized by the fact that although bio-synthetic manufacturing (in contrast to chemically synthesized active ingredients) is very complex, corresponding active ingredients can only be produced in this way.

Sales of biotech-based drugs have increased almost twenty-fold over the past 20 years, corresponding to a 12% compound annual growth rate (CAGR). Their share of the global drug market is also growing steadily: from 20% in 2012 to 30% in 2020. 70% of sales are generated by drugs produced by conventional means. However, looking at the Top 100 by sales, biotech drugs are now ahead with a share of more than half.

Biotech drugs are gaining further share with a view to the Top 20 pharmaceuticals by global sales. If nine biologics already achieved a 43% share in 2009, after 10 years this rose to 74% in 2019 based on the sales of 15 biologics.

For some pharma groups, biologics now account for a majority of their prescription drug sales (2019): Novo Nordisk (Denmark) 98%, Roche (Switzerland) 85%, Eli Lilly (U.S.) 63%, AbbVie (U.S.) 62%. However, this is based on different backgrounds or histories. Roche, for example, benefited from its early collaboration and later complete acquisition of U.S. pioneer Genentech. AbbVie profited from its 2001 acquisition of the former German Knoll AG from BASF, which had held a majority stake since 1975. The monoclonal antibody (Humira) developed there to combat rheumatoid arthritis is now by far the best-selling drug worldwide. In the case of other compounds listed in the Top 20, the biotech know-how also generally stems from a takeover or cooperation.

Biologics and especially monoclonal antibodies (25,000 atoms) are usually large molecules. Meanwhile, small biological molecules (short DNA or RNA and peptides) are also used as drugs, which are not classically seen as biologics. They can be considered as modern biopharmaceuticals in a broader sense. Strictly speaking, there are also classical biopharmaceuticals, i.e. therapeutic biological molecules that are not created by molecular biological methods but are extracted from natural sources.

Finally, biotech is not only the basis for bio-synthetic (fermentative) manufacturing of novel biologics. It also supports the development of small chemically synthesized compounds (so-called small molecules), because molecular biology elucidates disease causes at the molecular level. This then allows the design of targeted and effective agents that interact with disease-causing molecules, for example. There are now some cancer drugs based on this approach.

The pharmaceutical industry, and ultimately the part of the biotech industry that focuses on developing therapies, faces various industry-specific challenges. After all, bringing a drug to market is a very long, expensive and risky process. In fact, there is hardly any other product that is so complex to develop, mainly because of extensive testing on humans as well as a very stringent marketing authorization review.

The process is roughly divided into four phases: Research, Development (further subdivided into preclinical and clinical phases I to IV), Approval, and Market Introduction as well as Commercialization. From the idea or conception, twelve to 15 years can pass before a new drug reaches the market.

About the first five years are spent on research and preclinical testing, clinical testing takes another five to eight years, and approval one to two years. The time required varies depending on the indication for which a drug is being developed. The most time is required for diseases of the nervous system and for cancer.

The long time and high costs are partly due to the inefficiencies still prevailing in the operational process. The hope is to reduce these through increasing digitization or at least to halt further increases. The current pandemic has also shown that improved collaboration with each other and with regulatory authorities can accelerate processes. In this context, so-called "open innovation models" are also being discussed in the industry.

A very special feature of pharmaceutical development is the risk of failure. Despite good theoretical concepts, clinical development candidates may "fail" in reality. This is because safety (Phase I) and efficacy (Phase II) must be demonstrated during human testing. Phase III is used for validation in a large number of patients.

The attrition rate at start of phase I is more than 90%! At the start of phase II, it is still greater than 80%. Only at the beginning of phase III does it drop to around 50%. This means that half of all development candidates can still fail at this stage, and that after 10 years of development. Since failures can also occur in the research phase, in theory at least 15 to 25 drug candidates are needed on average to bring one drug to market.

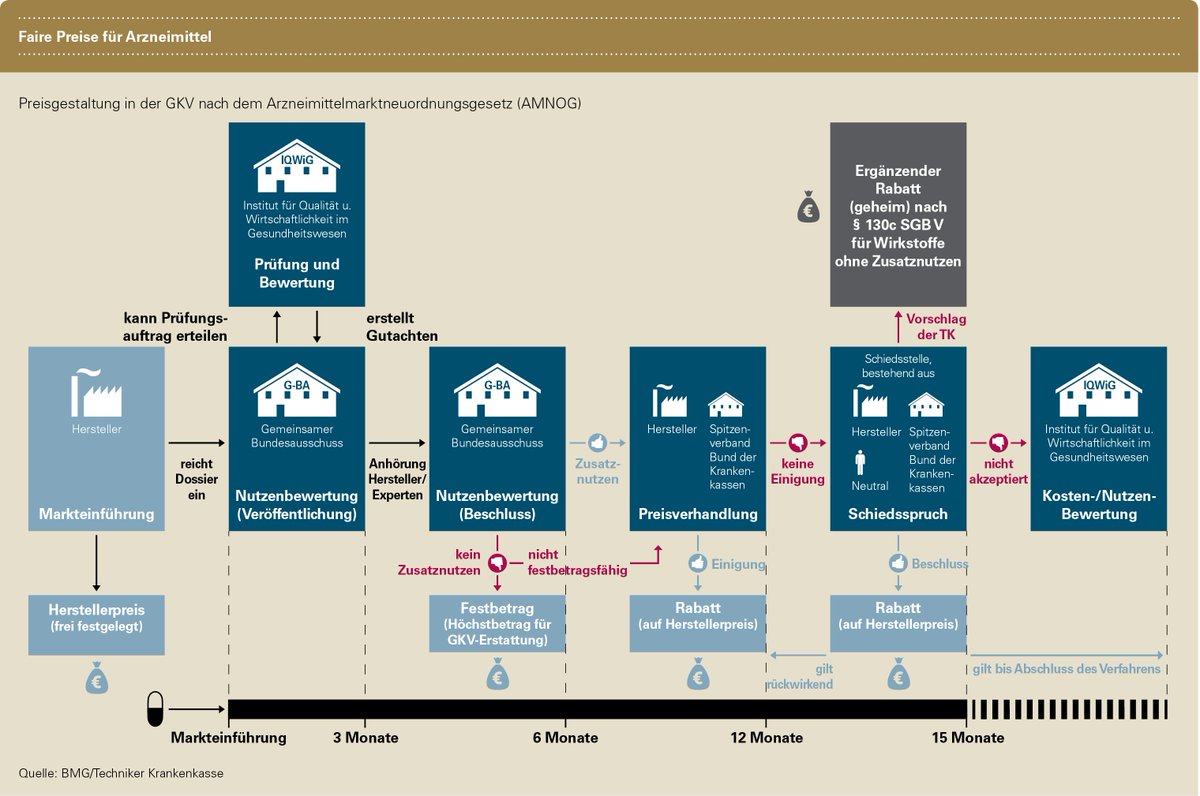

Another special feature of this market - even after official market approval - is the very highly regulated and complex marketing. For example, finding prices and generating revenues (reimbursement) are specially regulated. In industry jargon, this is known as market access. In Germany, for example, the German Pharmaceutical Market Reorganization Act (AMNOG), which came into force in 2011, stipulates that the price of a new drug be linked to its benefits. The aim of the AMNOG was and is to curb the rising expenditure on medicines by statutory health insurers.

For pharmaceutical as well as biotech companies, this creates a certain additional hurdle on the long road to bringing a drug to market. For many a smaller biotech company, the complex process cannot be managed alone. It makes sense here to enter into partnerships with larger biotechs or pharmas. A certain mutual "dependency" has thus developed in the industry.

The chemical industry developed more or less in parallel with the original fermentation industry. Towards the end of the 19th and beginning of the 20th century, the production of chemical fibers, paints and coatings, adhesives and plastics started. The rise of famous German chemistry before the World War I was mainly based on dye production. The aim was precisely to replace natural substances as starting materials and to synthesize a wide range of organic substances from domestic hard coal as well as from crude oil. Today it is clear that the use of such fossil resources causes major environmental damage. Thus, a return to renewable raw materials is immensely important for the future. Biotech will play a major role in this.

Fossil raw materials such as lignite, hard coal, peat, natural gas and crude oil are at the end also chemical substances that have developed in a geological process from the decomposition products of dead micro-organisms, plants and animals. Accordingly, they consist of organic carbon compounds and function as energy carriers that ultimately stored the solar energy of past times.

Thus, for chemical synthesis, the fossil, finite raw materials can in principle be replaced by biomass, which is available in the form of wood and other organic wastes and remains. In addition, the cultivation of plants also produces biomass, which, however, always competes with the cultivation for the food economy (agriculture). Biomass can also be produced in fermenters or reactors by "cultivating" micro-organisms such as algae, fungi or bacteria. These biological helpers can therefore be used not only for the production of useful substances (industrial biotechnology), but also as raw materials themselves.

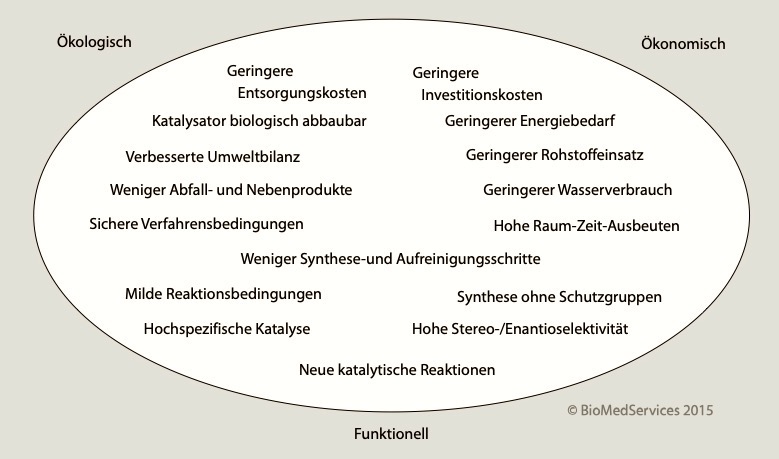

Biotechnological, i.e. fermentative, processing methods are environmentally friendly in addition to using renewable resources. This is because no extreme conditions are required as for chemical and physical processes (acids, high pressure, high temperatures). Previously, "biotech chemicals" were limited to intermediates of biological metabolism and therefore could not supply many synthetic chemistry products. Today, synthetic biology enables biobased products to be adapted to meet the needs of the chemical industry.

A 2015 review (Ten Years of the Bioeconomy: Review and Outlook) states that products based on renewable raw materials are only competitive if they are technically available only in this way (e.g., enantiomerically pure molecules), achieve a higher performance specification (e.g., long-chain monomers), or add value to a consumer product such as Coca-Cola's Plantbottle. In pure cost competition, alternative raw materials and processes are still falling behind because their extraction and processing have not yet been optimized to match the fossil process chains. Cost ratios might change with future surcharges for the use of fossil raw materials.

As "special" as the biotech industry appears, the fields of application and underlying technologies are broad. Keeping track of them is not that easy and requires industry expertise. The goal of Grasping Industry is to create higher-ordered as well as individual Biotech.Scripts (biotech analyses) and thus to bring light, sorting and insights into the jungle of news and information. "Scripts" according to the motto "the essence of intelligence is skill in extracting meaning from everyday experience".

Gladly also tailored to your specific questions. If you are interested, please contact us.